How to Handle Personal-and-Business Items (Without Losing Your Deduction)

Intro: Where most business owners go wrong Most small-business owners know their phone, internet, and home office are part of doing business — but few know how much they can

The biggest risk in your finances isn’t what’s obvious — it’s what’s overlooked.

Empowering Financial Insights with Data & Precision

Code. Analyze. Optimize.

Empowering Financial Insights With Data & Precision.

At Pettay Consulting LLC, we bridge the gap between traditional bookkeeping and high-level tax prep. We specialize in helping small business owners, CPAs, and accounting firms uncover missed deductions, clean up messy records, and create financial systems that actually make sense.

Using proprietary tools and deep IRS research, we go beyond data entry to ask why you spent it, how it should be categorized, and whether it can save you money.

We don’t just log transactions — we analyze them.

We don’t just clean your books — we make them work for you.

We find what others overlook — organize it with purpose, and make it usable.

Whether you’re prepping for year-end, applying for funding, or simply want clarity in your numbers, Pettay Consulting brings insight, structure, and confidence to your finances.

Delivering streamlined financial solutions with precision, efficiency, and trust.

Every dollar has a story—we make sure it counts.

This is where it starts: reviewing each charge, questioning its purpose, and aligning it with IRS guidelines to uncover deductions most bookkeepers overlook. This includes:

What we do

Line-by-line review of transactions (business + personal where relevant)

Identify missed deductions, mixed-use items, and documentation gaps

Align categories to defensible IRS guidance; propose QBO rules to prevent repeats

Why it matters

Legitimate write-offs are often mislabeled—not missing

Cleaner coding → fewer CPA delays, faster filing, lower audit risk

What you receive

Deduction summary & savings opportunities

Red-flag log with notes (keep, adjust, or exclude)

Category updates for QBO / Excel and suggested automations

Example Case: “John Smith”

Chase Bank Statement (PDF) – Grey Areas

Navy Federal Credit Union Statement (PDF) – Grey Areas

Discover Credit Card Statement (PDF) – shows charge from Web.com

Vendor Research: Web.com BBB Rating Review, Fraudulent Charge

IRS Source References: Pub 334 (Ordinary & Necessary), Pub 519

This step builds the foundation for accurate reporting — before any summary, P&L, or hand-off is created.

Every transaction is accounted for — nothing gets missed.

We don’t just track — we translate.

Once your transactions are reviewed, we build detailed, customized reports that make handoff effortless for CPAs, SBA lenders, or tax teams.

From clean profit & loss statements to reconciled ledgers, every figure is backed by documentation and categorized to match your industry and accounts. Our process includes complete General Ledger Cleanup — correcting mis-coded entries, balancing accounts, and ensuring your data is audit-ready.

What’s included:

Built in your current accounting software, or custom software as needed

Full General Ledger Cleanup and account reconciliation

Organized by bank and account

Fully categorized with Profit & Loss Categories

CPA- and SBA-ready formatting

Linked source documents and notes

Stop scrambling at tax time — start handing off with confidence.

We bring structure to your system — not just your statements.

Your QuickBooks should give you answers, not more questions. Our optimization process fine-tunes every detail — from your chart of accounts to vendor records — ensuring your reports, balances, and categories align with how your business truly operates.

We collaborate directly with your current CPA or bookkeeper to eliminate miscommunication, align categories, and maintain consistency across every report.

What’s included:

Chart of Accounts cleanup and category review

Vendor cleanup and account adjustments

Balance Sheet and Profit & Loss review

Coordination with CPA and/or Bookkeeper for unified data flow

Final recommendations to improve clarity and prevent duplication

A well-structured system saves time, reduces rework, and gives your team confidence in every number.

Your business and personal spending don’t live in silos — and the IRS knows it.

We review transactions across your personal and business accounts to identify mixed-use areas like travel, home office, continuing education, and digital tools.

Every expense is evaluated for defensible allocation and categorized for compliance, giving you a clear picture of what belongs to your business, what doesn’t, and how to document the difference.

What’s included:

Review of personal and business transactions for overlap

Identification of mixed-use categories (home office, travel, education, subscriptions)

Allocation guidance based on IRS rules

Recommendations for record-keeping and supporting documentation

Adjusted transaction mapping for QBO or Excel systems

The result? A transparent, defensible record that keeps your deductions clean and compliant — even in the gray areas.

We don’t guess — we research, verify, and prove.

Once your data is organized, we investigate the why behind the numbers. Each expense category, deduction, and trend is validated through direct IRS reference, financial publication cross-checks, and multi-year pattern review.

We don’t stop at totals — we study context. That means pulling IRS Publication 463 for mixed-use categories such as travel, meals, entertainment, and vehicle expenses; Pub 535 for business deductions; and Pub 587 for home-office allocations. Every conclusion is backed by primary-source research and comparative industry benchmarks.

Our research and analysis include:

Detailed review of quarterly and annual financial data for irregularities or missed opportunities

IRS publication and tax-law cross-reference for each deduction type

Comparative study of fuel vs. mileage, home-office allocation, continuing-education deductions, and other mixed-use assets

Multi-year trend analysis to identify behavioral or seasonal shifts in spending

Benchmarking against industry standards, client-segment norms, and historical ratios

Compilation of a research summary with citations and supporting documentation

Deliverable:

A data-backed findings report — clear, annotated, and defensible — showing where opportunity exists, what’s already optimized, and how each conclusion was verified.

Your numbers deserve context, not assumption. Through documented research and applied analysis, we convert compliance into confidence — proof into profit.

From data to direction — we turn insight into action.

Once the numbers are proven, strategy begins. This service focuses on real-time application: aligning your financial data, systems, and tools so every platform speaks the same language.

We coordinate between Excel, QuickBooks, CRMs, and websites — updating codes, categories, and tags to ensure your reports reflect the full scope of your business. For clients managing multiple companies or income streams, we review cross-entity transactions and design a unified tracking structure that keeps each operation distinct but connected.

What’s included:

Updating and standardizing Excel files to match CRM or website coding structures

Reviewing transactions across multiple businesses under one owner for proper separation and reporting

Guidance on what to track, how to label, and where to record supporting documentation

Quarterly strategy sessions to review trends, discuss adjustments, and realign focus

Ongoing consultation to bridge gaps between financial systems and operational goals

Outcome:

You leave with clarity, not just compliance — a cohesive ecosystem where every tool, report, and process works together to tell the same financial story.

Every business is different — so our process starts with listening. We begin with a detailed conversation to understand your entire financial picture: how information is stored, how personal and business expenses are intertwined, and where gaps might exist.

When questions arise and standard sources don’t provide clarity, we don’t guess — we investigate. Any gray areas are flagged and prioritized for deeper review. We leave no stone unturned.

While others rely solely on surface-level platforms or dashboards, we take a deeper approach. From identifying duplicate charges and miscategorized expenses to flagging potential fraud, we ensure your financial data is accurate, clean, and built for trust.

Because helpful isn’t good enough — it needs to be correct.

Skilled in Excel, Salesforce, and data pattern analysis — translating complex information into clear trends, solutions, and strategic insight.

We go beyond surface-level numbers to create tailored systems that align with how your business actually operates. There is no one-size-fits-all here.

From cleaned-up ledgers to missed deductions recovered, our work leads to decisions backed by clarity — not guesswork.

Whether you’re seeking clean Profit & Loss statements, a full expense review, time-saving systems, or customized reporting — we’re here to bridge the gap between your spending and your strategy.

Schedule your free consult today and let’s talk through your goals.

Born and raised in Tampa, Florida, Amanda Pettay is a native Floridian with a lifelong fascination for how systems work — whether mechanical or financial.

After more than 15 years of experience in data analysis, process engineering, and financial strategy, Amanda’s career took an unexpected turn in 2023 when she was laid off. What could have been a setback became a catalyst. The trusted professional relationships she built over the years became the foundation for something greater — the creation of Pettay Consulting, LLC, a firm designed to bridge the gap between bookkeepers, CPAs, and business owners navigating the space in between.

That same year brought a deeply personal challenge. Amanda had rescued a severely abused dog named Boyd, with whom she formed a profound bond. After 18 months together, Boyd unexpectedly bit her — a traumatic event that, because of its severity, resulted in his euthanasia. In the midst of that heartbreak, Amanda adopted Banjo, whose bright spirit and unwavering loyalty helped bring healing and new purpose. Today, he proudly serves as Pettay Consulting’s Chief Barketing Officer.

Banjo’s story mirrors Amanda’s own — a reflection of resilience, compassion, and rebuilding after adversity.

Pettay Consulting was founded on that same philosophy: precision with empathy, strategy grounded in integrity, and a commitment to helping every client find clarity and confidence in their financial systems.

At the heart of Pettay Consulting, LLC is Banjo — the firm’s official Chief Barketing Officer (CBO) and energetic anchor behind the scenes.

Banjo specializes in emotional regulation, environmental grounding, and energetic support during complex financial cleanups. While Amanda tackles the data, Banjo ensures the environment stays calm, clear, and centered.

From silent check-ins during high-stress audits to spontaneous appearances during Virtual Meetings, Banjo intuitively knows when the energy needs a reset. His role isn’t just cute — it’s part of the firm’s commitment to service with integrity, presence, and heart.

Banjo doesn’t bark orders — but he does lead by example.

Specialties:

EXCELLENTTrustindex verifies that the original source of the review is Google. Amanda has helped my business tremendously. Her knowledge of accounting rules/principles and the tax code is unmatched. We highly recommend Pettay Consulting to anyone who wants cleaner books and more knowledge about how your financials can work for you and your business!Trustindex verifies that the original source of the review is Google. Pettay Consulting have transformed our financial operations with their intuitive, efficient platform. Their exceptional customer support is always professional and solution-focused, making the entire experience seamless. We’ve seen improved accuracy, time savings, and greater financial clarity. Highly recommend them as a trusted partner for any business!Trustindex verifies that the original source of the review is Google. Amanda did an incredible job providing financial organization for my small businesses. I would highly recommend Pettay Consulting to anyone seeking solutions for tax preparation.Trustindex verifies that the original source of the review is Google. I had the pleasure of working with Amanda Pettay at Pettay Consulting, and I can't recommend her services enough! Amanda has a unique ability to break down complex financial situations and present clear, actionable plans. She helped me organize my budget, analyze my expenses, and provided invaluable advice on building my credit. Her personalized approach and genuine care for her clients make her stand out in her field. Thanks to Amanda's expertise, I've gained financial clarity and feel more confident about my financial future. If you're looking for a financial consultant who is knowledgeable, professional, and truly dedicated to her clients' success, Amanda Pettay is the one to call!

Intro: Where most business owners go wrong Most small-business owners know their phone, internet, and home office are part of doing business — but few know how much they can

Running a small business comes with endless questions about deductions, expenses, and how to stay compliant with the IRS — without losing your sanity.At Pettay Consulting, I help decode your

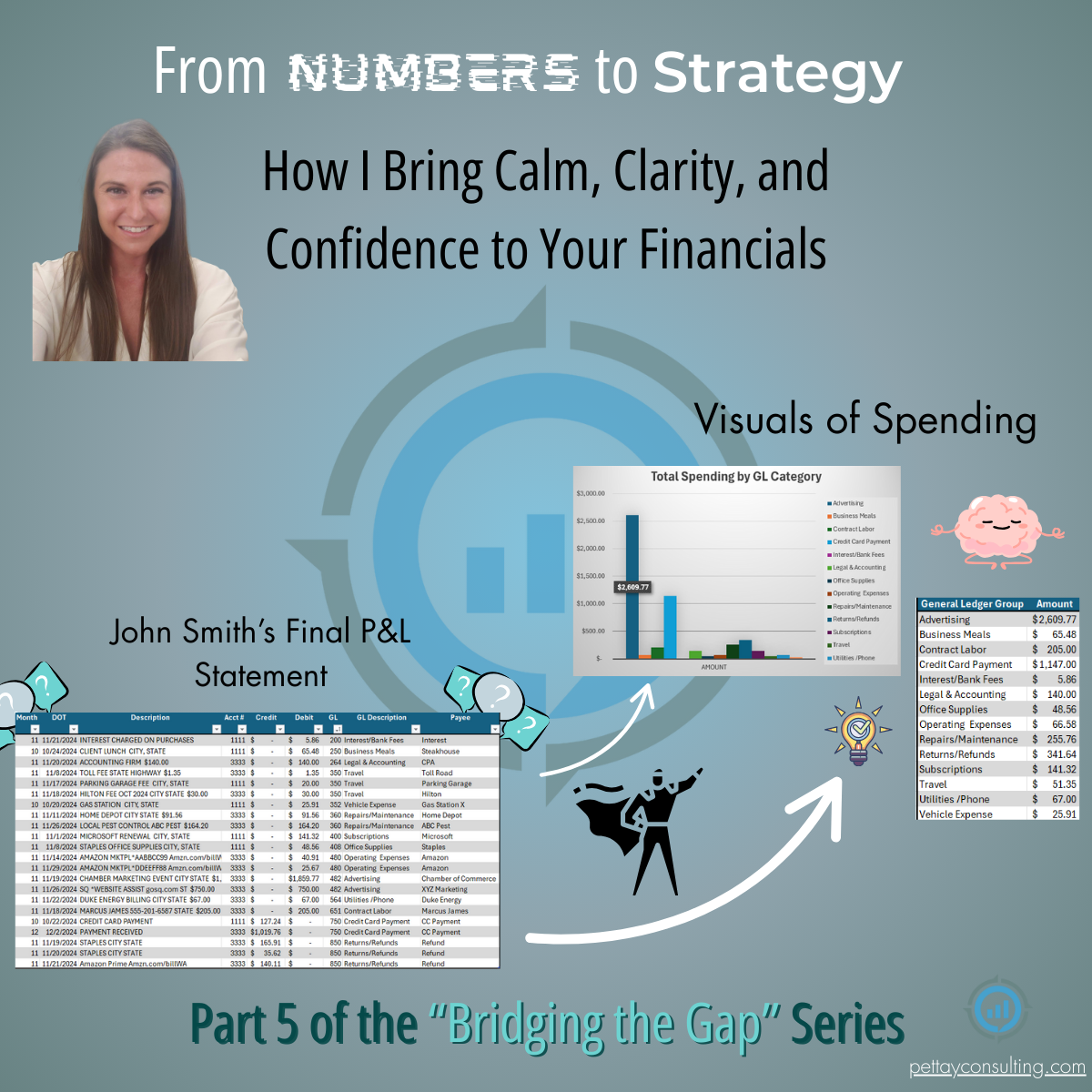

Part 5 of the “Bridging the Gap” Series How I Turn Numbers Into Strategy (Without Overwhelm) Let’s be honest:Most people avoid financial strategy because it feels… heavy. The numbers are

Part 4 of the “Bridging the Gap” Series By the time a client calls me, the numbers are usually already in a system—QuickBooks Online, an Excel sheet, or scattered in

From the “Bridging the Gap” Series You can have a bookkeeper, a CPA, and still be losing money.Not because someone’s doing anything wrong—but because no one’s looking close enough. In

Part 2 of the “Bridging the Gap” Series When it comes to financial data, most people focus on what happened. The bookkeeper says: “It’s categorized and reconciled.” The CPA says:

Schedule a time that works for you and let’s discuss how we can streamline your financial workflows. Select an available slot below or reach out via our contact form.

Palm Harbor, Pinellas County, FL.

Monday - Friday 9 AM - 5 PM

Copyright © 2025 All rights reserved – Pettay Consulting, LLC