By the time a client calls me, the numbers are usually already in a system—

QuickBooks Online, an Excel sheet, or scattered in transactions across multiple accounts.

It’s not about missing data.

It’s about the disconnect between what’s recorded and what’s actually understood.

In Part 1, we broke down the roles.

In Part 2, we talked about the questions no one else is asking.

In Part 3, we looked at where money quietly disappears.

Now let’s talk about the tools I use to spot what others miss—and how I bring the whole picture into focus.

You don’t need a complicated stack of software.

You need a few clean systems and the right lens to interpret what they’re showing you.

The following is what I use with clients to bring the chaos into clarity.

I build spreadsheets that are tailored to how you operate—not one-size-fits-all.

What they include:

Why it works: These tools don’t just track—they help you think.

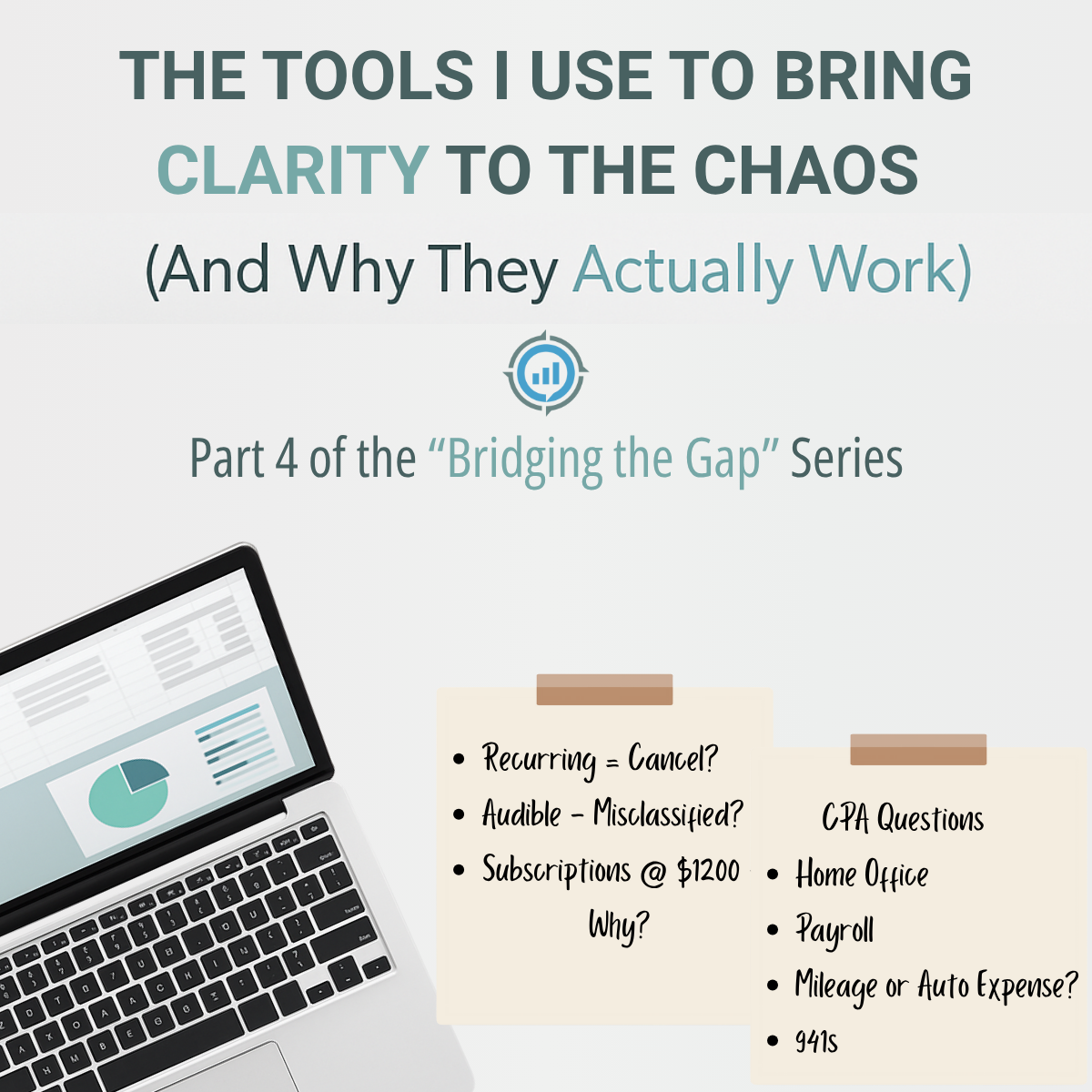

This is where we, you and I together, look at every outgoing transaction and ask, “Does this still make sense?”

I scan for:

Why it works: You can’t make smart decisions if your data is cluttered or misleading. When items are flagged for review, it allows you to easily see what should be reviewed, ultimately saving you time and money.

Many clients already have QBO—or a bookkeeper who uses it.

That’s great. But it’s often set up for compliance, not clarity.

I help by:

Why it works: QBO is the tool. Interpretation is the value.

Every tool I build includes space for questions, audit notes, and internal clarity.

Clients often say:

“I finally feel like I can ask questions about this.”

I leave prompts like:

Why it works: Clean data is helpful. Contextual data is powerful.

Some clients come in for a one-time financial reset—often after a messy year, a new business entity, or before tax prep.

Others stay month to month, using our tools as a checkpoint and a strategy guide.

Either way, the point is the same:

Stop flying blind. Start seeing clearly.

How I Turn Numbers Into Strategy (Without Overwhelm)

Schedule a time that works for you and let’s discuss how we can streamline your financial workflows. Select an available slot below or reach out via our contact form.

Palm Harbor, Pinellas County, FL.

Monday - Friday 9 AM - 5 PM

Copyright © 2025 All rights reserved – Pettay Consulting, LLC