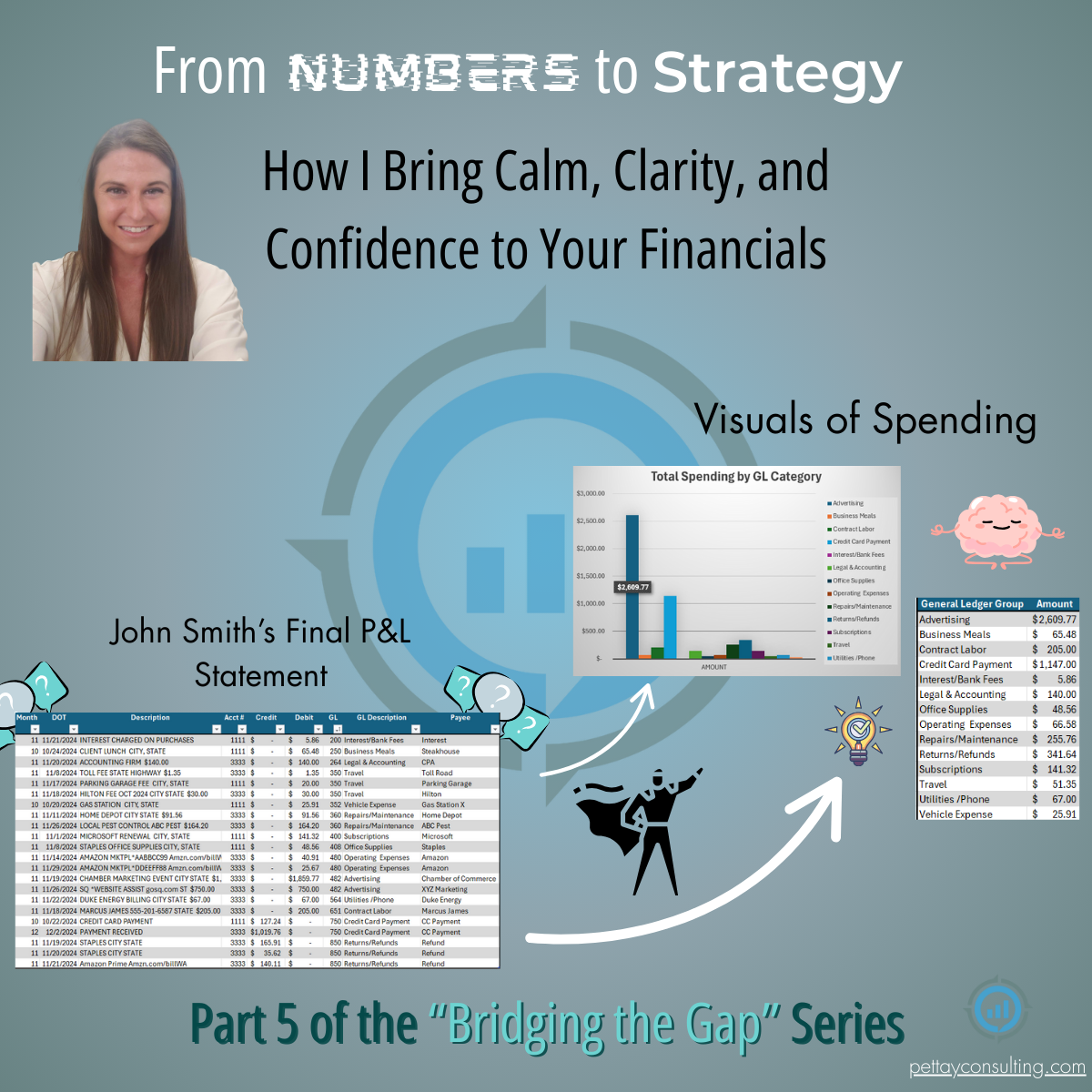

Part 5 of the “Bridging the Gap” Series

Let’s be honest:

Most people avoid financial strategy because it feels… heavy.

The numbers are already in a system.

There are reports. Categories. Deadlines.

But turning that into clarity and direction?

That’s where people get stuck.

They assume strategy means:

But that’s not how I work.

When I sit down with a client’s numbers, the first step is presence—not pressure.

No jargon. No overwhelm.

We walk through what’s already there and ask:

From that place, we begin to layer in insight.

A report is just a snapshot.

But strategy comes from interpreting that snapshot in context.

Real examples:

That’s the difference between numbers… and knowledge.

I don’t just accept what’s there.

I read between the lines. I ask questions. I do the research most people don’t have time to do.

Once the truth is clear, we figure out:

Now what?

This might look like:

All in plain English. All without drama.

Clients often say:

“This feels doable.”

“I’ve never felt this clear about my numbers.”

“I didn’t know strategy could feel this grounded.”

You just need someone who:

This is how I turn numbers into strategy—without stress, without overwhelm.

This entire series has been about filling the space between:

With the right support, that gap becomes a bridge.

And when crossed with intention, it leads to:

If it’s time to bring clarity, strategy, and calm to your finances—

Let’s talk.

Schedule a Consultation

or

Reach Out with a Question

You don’t have to figure this out alone.

Schedule a time that works for you and let’s discuss how we can streamline your financial workflows. Select an available slot below or reach out via our contact form.

Palm Harbor, Pinellas County, FL.

Monday - Friday 9 AM - 5 PM

Copyright © 2025 All rights reserved – Pettay Consulting, LLC